Campbell County Va Real Estate Tax Assessment

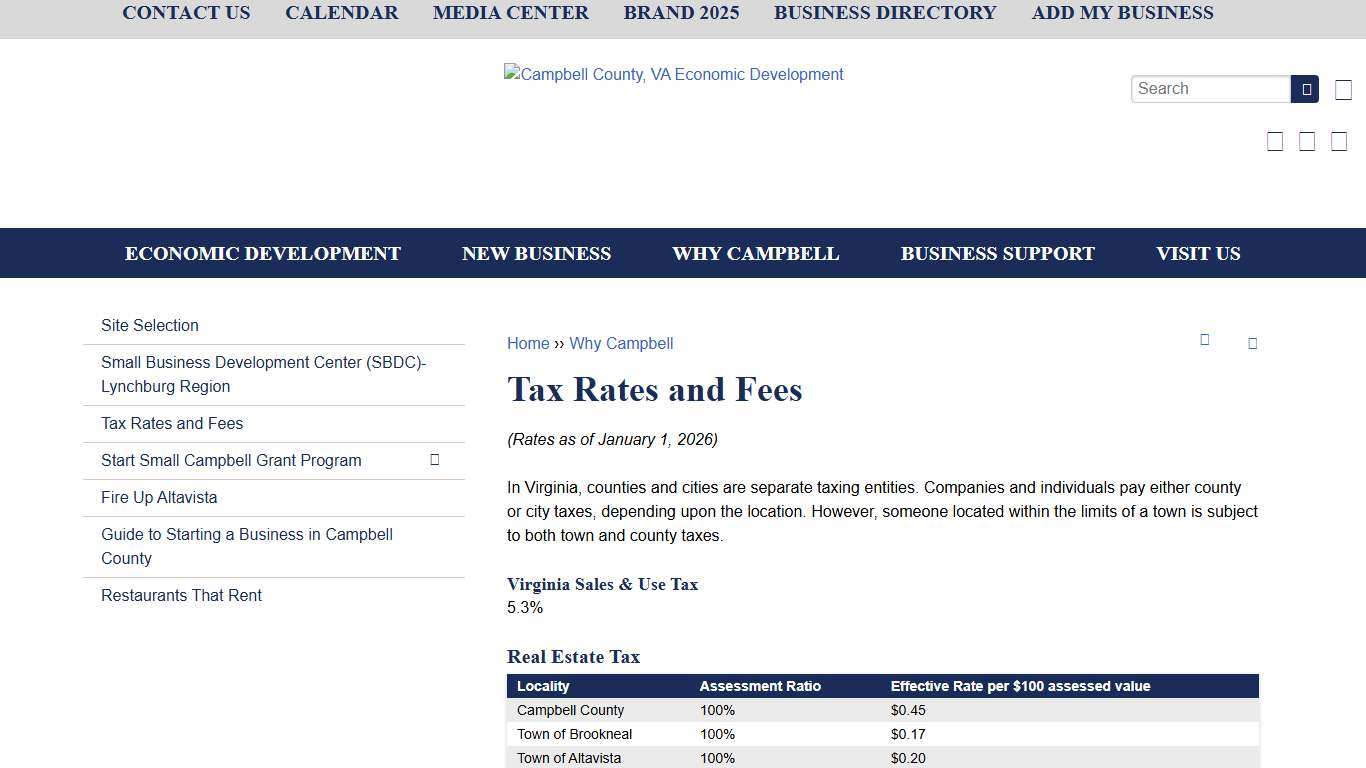

Tax Rates and Fees Campbell County, VA Economic Development

(Rates as of January 1, 2026) In Virginia, counties and cities are separate taxing entities. Companies and individuals pay either county or city taxes, depending upon the location. However, someone located within the limits of a town is subject to both town and county taxes.

https://www.campbellvirginia.com/new-business/pages/tax-rates-and-fees

Campbell County Board of Supervisors

Real Property Tax (Rollback Taxes/Minerals/Real Estate); Real Property Tax ... Fiscal Year 2025-2026 Proposed. $49,712,492, $51,987,547. 13. $2,275,055 ...

https://www.co.campbell.va.us/DocumentCenter/View/14595/FY-2026-Budget-PresentationBoard of Supervisors Meeting February 25, 2025

The Board came to a consensus to authorize staff to advertise the tax rates for a public hearing on the Fiscal Year 2026 Budget on March 25th, ...

https://www.co.campbell.va.us/AgendaCenter/ViewFile/Item/5916?fileID=9070Sheet1 - Campbell County

FY 2026 - TAX RATES: 187. 188, Real Estate, $0.45 per $100 of assessed value. 189, Personal Property, $3.95 per $100 of assessed value (with the exception that ...

https://www.co.campbell.va.us/AgendaCenter/ViewFile/Item/5612?fileID=8792Campbell News Flash • Campbell County, VA • CivicEngage

The 2023 assessment notices are currently being mailed. Please note that these notices reflect the revised assessed value as of January 1, 2023 for the property described in the “CHANGE IN ASSESSED VALUE” block of the document. As required by Section 58.1-3201 of the Code of Virginia, your property has been assessed at 100% of its fair market value.

https://www.co.campbell.va.us/CivicAlerts.asp?AID=550&ARC=957

Fiscal Year 2025 Local Estimates

Enclosed are the Fiscal Year 2025 estimates for the distributions of the Local. Option Sales and Use Tax. Included in the 2024-2026 ...

https://www.tax.virginia.gov/sites/default/files/inline-files/fy25-local-estimates-sales-taxes.pdfCampbell News Flash • Campbell County, VA • CivicEngage

Property reassessments are conducted every four (4) years, as required by state law, to determine fair market value of land and properties for equitable taxing purposes. Campbell County has contracted with Wampler-Eanes Appraisal Group, LTD to conduct on-site visits of each property in the locality.

https://www.campbellcountyva.gov/CivicAlerts.asp?AID=543&ARC=950

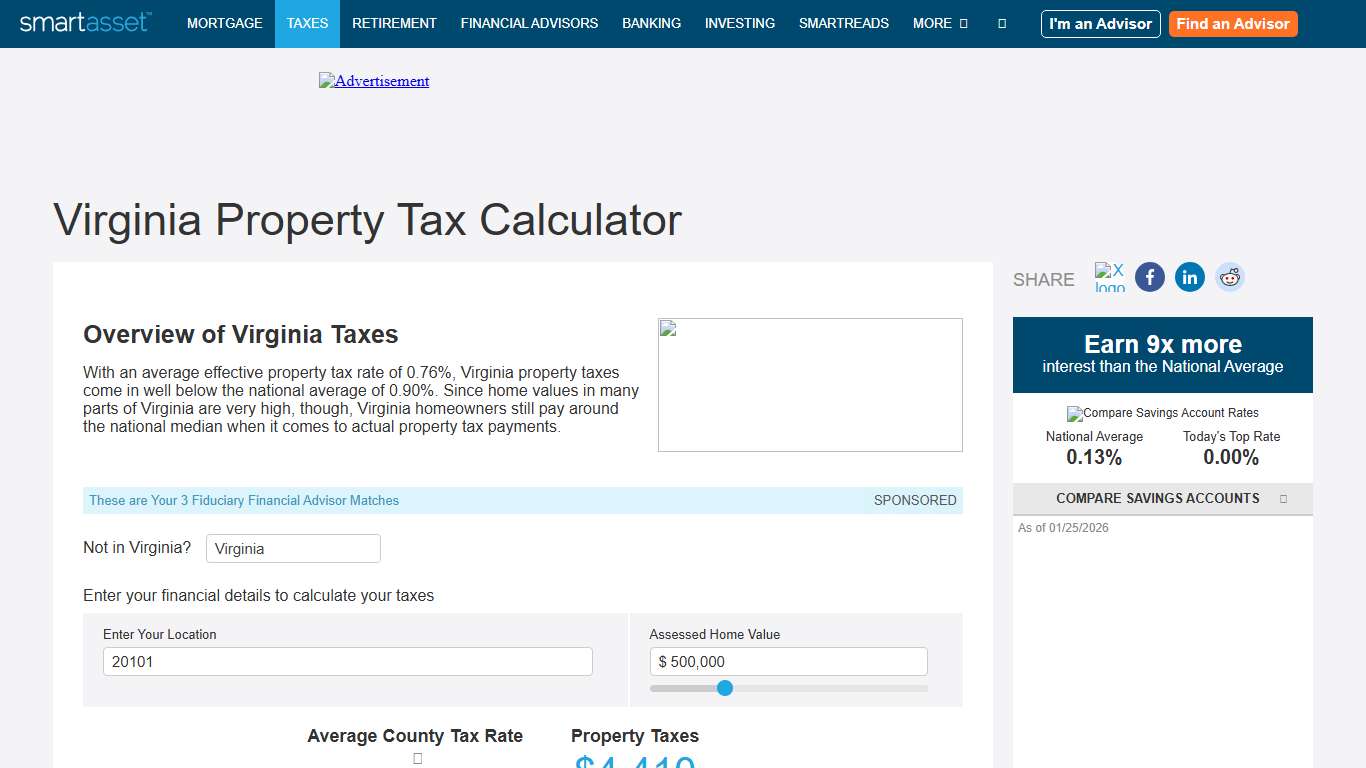

Virginia Property Tax Calculator - SmartAsset

Overview of Virginia Taxes With an average effective property tax rate of 0.76%, Virginia property taxes come in well below the national average of 0.90%. Since home values in many parts of Virginia are very high, though, Virginia homeowners still pay around the national median when it comes to actual property tax payments.

https://smartasset.com/taxes/virginia-property-tax-calculator

Campbell County Board of Supervisors lowers property tax, adopts new budget

Campbell County residents will see a reduction in personal property taxes after the board of supervisors voted to adopt the fiscal year 2025 budget this week. Campbell County residents will see a reduction in personal property taxes after the board of supervisors voted to adopt the fiscal year 2025 budget this week.

https://newsadvance.com/news/local/campbell-county-board-of-supervisors-lowers-property-tax-adopts-new-budget/article_82d75242-f378-11ee-b581-1b7aad7e55de.html

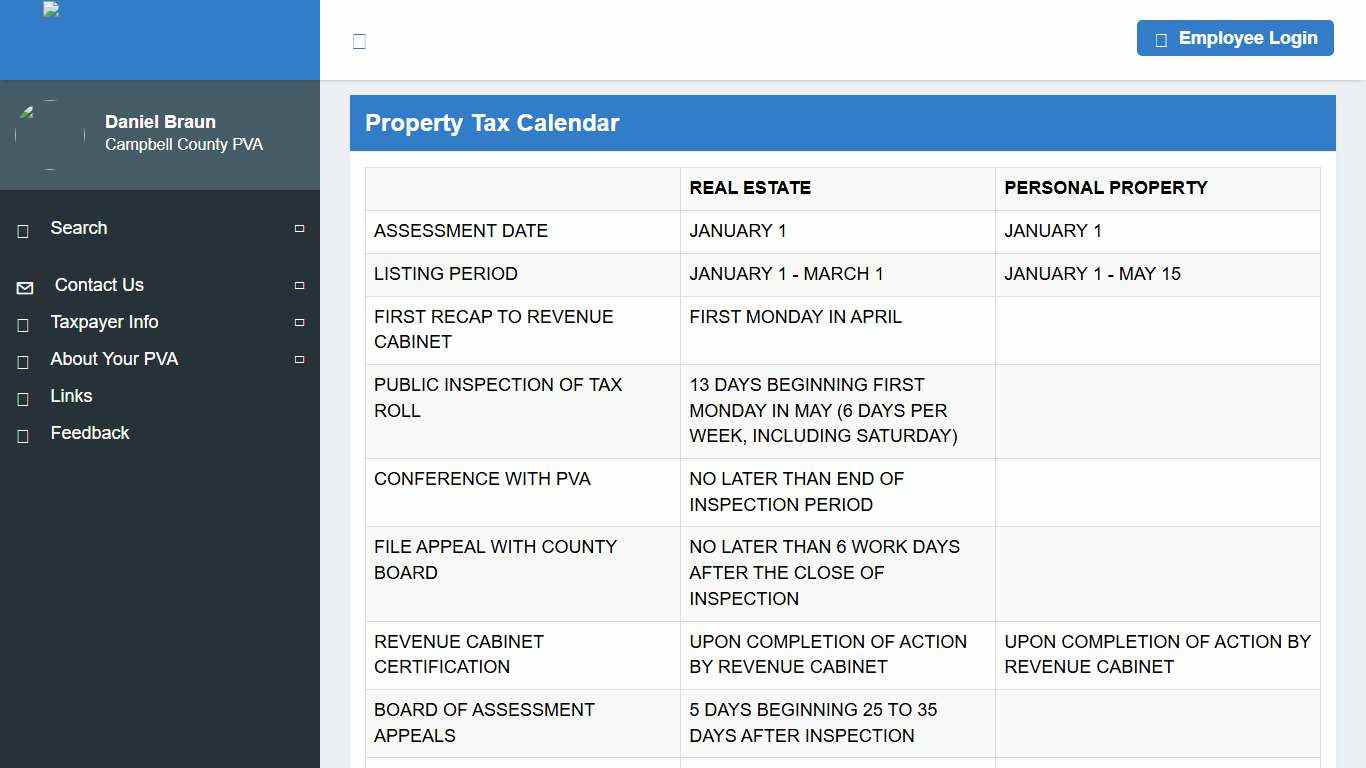

Campbell County PVA

A Software Management, LLC application for managing and searching for land parcels...

https://pva.campbellcountykentucky.com/Page/property-tax-calendar

Amherst County Community Chat Regarding Tax Assessments Facebook

Regarding Tax Assessments. According to my letter, the new tax rate has not been established yet. When it is set it will begin 2026, not this year. You should appeal your assessment first! Sit down with the assessor and have them explain how they came up with the amount.

https://www.facebook.com/groups/4076884595878938/posts/4354895471411181/

2026 Campbell County County Sales Tax Rate - Avalara

Campbell County sales tax details The minimum combined 2026 sales tax rate for Campbell County, Virginia is 5.3%. This is the total of state, county, and city sales tax rates. The Virginia sales tax rate is currently 4.3%. The Campbell County sales tax rate is 1.0%.

https://www.avalara.com/taxrates/en/state-rates/virginia/counties/campbell-county.html

Flipping Houses in Campbell County VA [2026 Analysis] How to Flip Homes

Overview Campbell County Real Estate Investing Market Overview Over the most recent ten years, the population growth rate in Campbell County has an annual average of 0.20%. By contrast, the average rate at the same time was 0.81% for the full state, and 0.69% nationwide.

https://housecashin.com/investing-guides/flipping-campbell-county-va/![Flipping Houses in Campbell County VA [2026 Analysis] How to Flip Homes](screenshots/campbell_county_va_real_estate_tax_assessment_17.jpg)

Campbell County, VA Official Website

- Never Miss What’s Happening ALL AROUND THE COUNTY - RUSTBURG, VA - The Campbell County Planning Commission meeting scheduled for Monday, January 26, 2026 has been rescheduled due to inclement weather. Public hearings will be heard at the next business meeting on Monday, February 23, 2026.

https://www.co.campbell.va.us/

Delinquent Taxes - Campbell County Clerk's Office

Delinquent Taxes The 2025 Campbell County Delinquent Sale will be held Wednesday, August 13, 2025 at 10:00 am at the Fiscal Court Chambers located a 1098 Monmouth Street, Newport, KY 41071. The last day to pay delinquent taxes is Tuesday, August 12, 2025 at 4:00 pm.

https://campbellcountyclerk.ky.gov/delinquent-taxes/